- FOMC minutes highlight concerns over persisting inflation

- Flash Manufacturing and Services PMI positively beat expectations

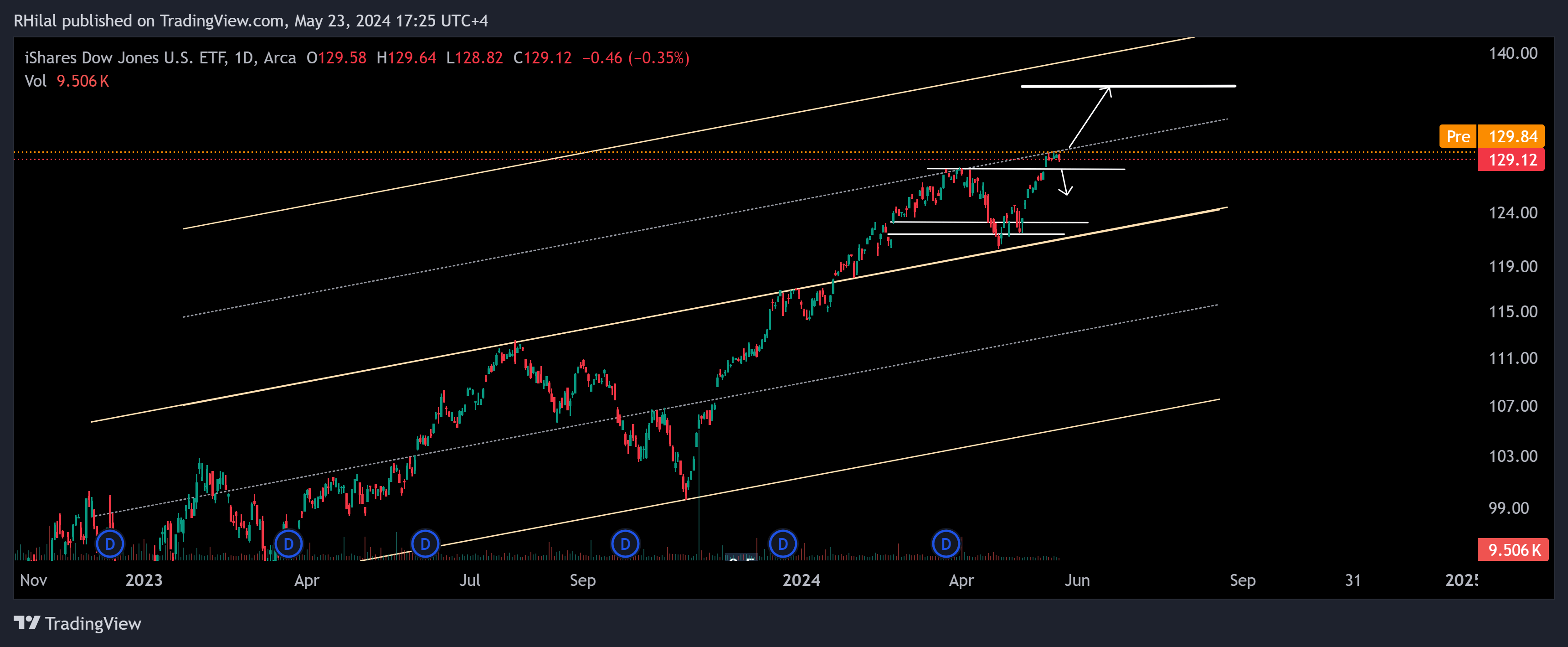

- iShares Dow Jones ETF hovers above its April highs

- Dow struggles to firmly break through 40000

The recent market euphoria, driven by a slight down tick in U.S inflation, faced a correction along its trajectory with yesterday’s hawkish FOMC minutes. U.S bond yields proceeded in an uptrend this week and unlike the Nasdaq and SP500, the US30 is still ahead of a firm record breakout above its April highs.

With the iShares Dow ETF (IYY) flagging indecisively above April highs and Nasdaq trending through record highs amid strong AI grounds, the sentiment on US 30 is yet to shift beyond the Fed’s hawkish outlook.

Tracing Elliott waves, a fresh trend was established during April lows, coinciding near the previous 37130 wave 4 in January in the following manner:

Dow Jones Forecast: Daily Time Frame – Logarithmic Scale

Tracing a potential fourth wave along the trend, the probability for an uptrend continuation remains valid. However, a firm breakout above the 40000 is needed to confirm the trajectory of the index towards the 40600 and 41000 zones respectively. On the downside, as the Dow is proceeding lower this week, the wave retracement can find potential support levels near 39300 and 39100 zones consecutively prior to a bullish rebound. An aggressive scenario can hold near 38600.

Dow Jones Forecast: IYY iShares Dow – Daily Time Frame – Logarithmic Scale

From an ETF perspective, the IYY is flagging indecisively above its all-time high, touching a mid-channel resistance. An upward breakout would pave the way for a stronger bullish sentiment driving the ETF toward the upper zone of the channel. On the downside, a break back below the previous high might reverse the sentiment, shifting it back into bearish mode.