(Click to enlarge charts)

(Click to enlarge charts)

What happened yesterday

The German 30 Index (proxy for the DAX) has continued its lacklustre performance into the U.S. session. It has challenged the 10060 daily pivotal support but interestingly, it has managed to stage a “comeback” rebound in today’s Asian trading session.

Please click on this link for a recap on our previous daily outlook.

Key elements

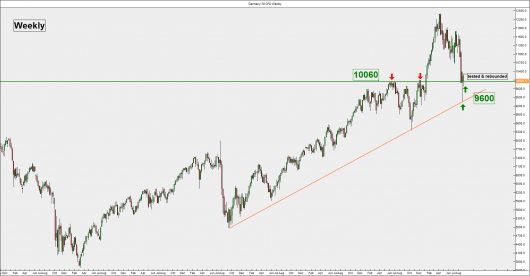

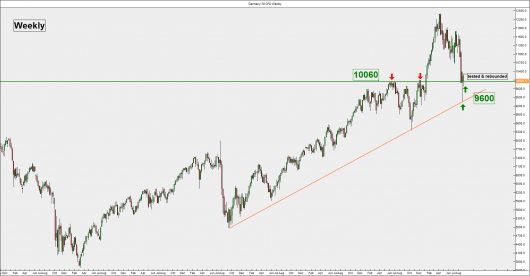

- The 10060 support is a considered as a critical psychological level as it was a previous resistance that capped the Index in June 2014 and November/December 2014 before the bullish breakout occurred on 11 January 2015. Last week’s “Black Monday”, 24 August 2015 crash has managed to end the week with a positive close above the 10060 level (see weekly chart).

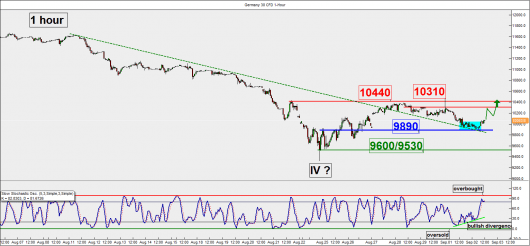

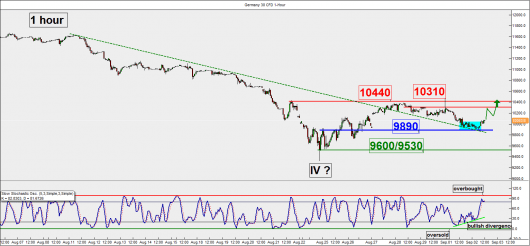

- Yesterday’s decline can be considered a “whipsaw” around the 10060 support level as price action managed to hold and rebound off the former short-term trendline resistance now turns pull-back support (in dotted green) (see 1 hour chart).

- The hourly (short-term) Stochastic has also traced out a bullish divergence signal at its oversold region which reinforces a potential turnaround in price action from the on-going decline in place since last Friday, 28 August 2015 (see 1 hour chart).

- The next support to watch will be the long-term level at 9600 which is also the 34-month Moving Average (see monthly chart).

Key levels (1 to 3 days)

Pivot (key support): 9890 (to tolerate the whipsaw)

Resistance: 10310 & 10440

Next support: 9600/9530

Conclusion

Based on a closer examine of the current short-term technical elements, we have decided to maintain our initial bullish bias and considered yesterday’s movement as a whipsaw around the 10060 support.

As long as the 9890 daily pivotal support holds, the Index is likely to stage a potential recovery towards 10310 before the short-term range top at 10440.

However, failure to hold above the 9890 pivotal support may invalidate our bullish expectation for a slide to test the long-term support at 9600/9530.

Charts are from eSignal & City Index Advantage Trader

Disclaimer

This report is intended for general circulation only. It should not be construed as a recommendation, or an offer (or solicitation of an offer) to buy or sell any financial products. The information provided does not take into account your specific investment objectives, financial situation or particular needs. Before you act on any recommendation that may be contained in this email, independent advice ought to be sought from a financial adviser regarding the suitability of the investment product, taking into account your specific investment objectives, financial situation or particular needs. All queries regarding the contents of this material are to be directed to City Index, a trading name of GAIN Capital Singapore Pte Ltd.

Trading CFDs and FX on margin carries a high level of risk that may not be suitable for some investors. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice. Visit cityindex.com.sg for the complete Risk Disclosure Statement.