- Saudi Arabia cut prices for Arab light crude delivery to Asian customers in February to the lowest level since November 2021

- Citigroup analysts expect selling from funds this week following annual revisions to weightings in benchmark commodity indices

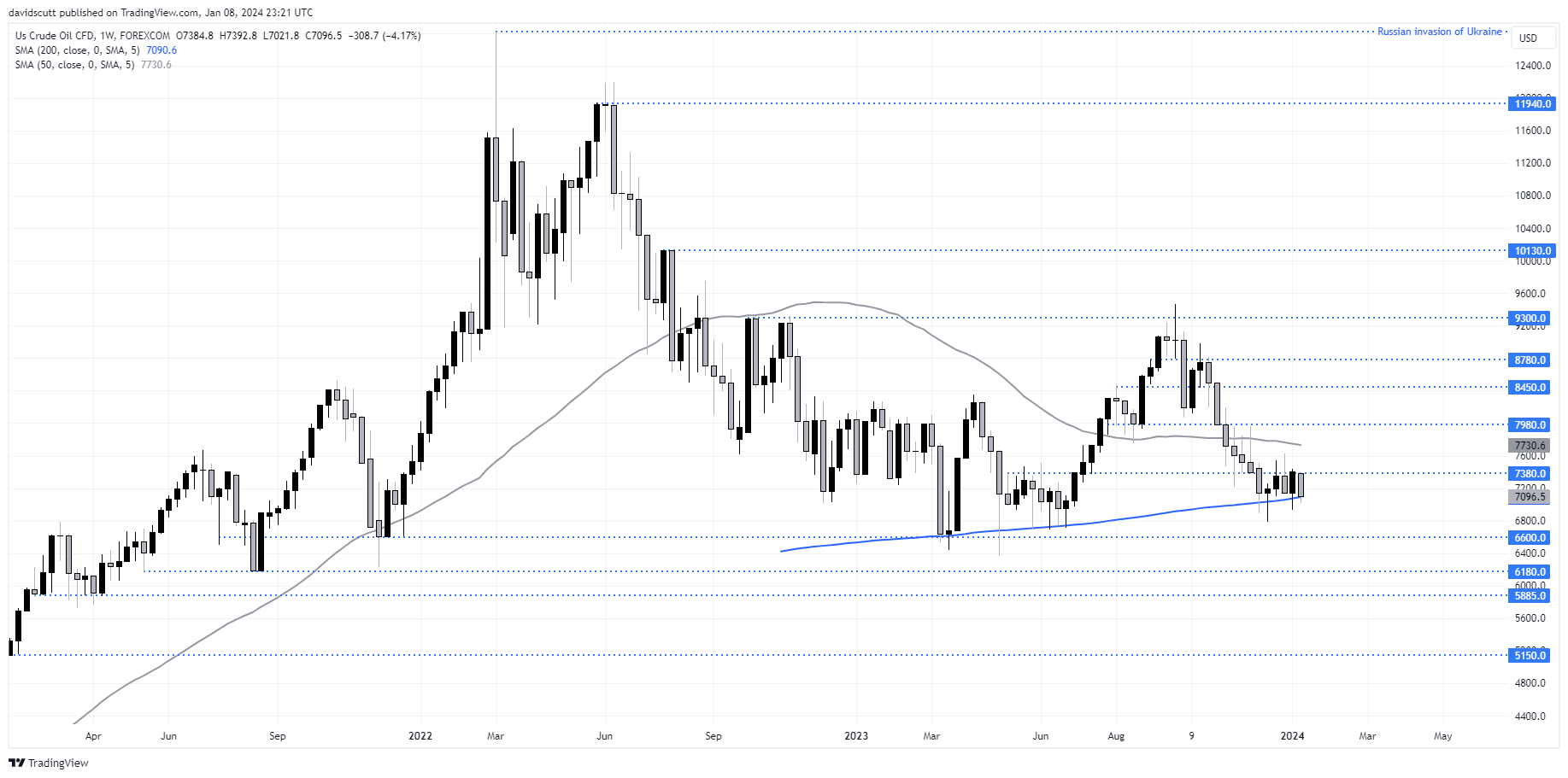

- WTI crude is back testing its 200-week moving average, a level it has bounced from throughout 2023

US crude oil prices were hammered to start the trading week, undermined by news major exporter Saudi Arabia has reduced the price for benchmark Arab Light crude to Asia by $2 a barrel for February delivery, a larger cut than expected leaving prices at the lowest level since November 2021.

The downdraft for crude futures was immediate, resulting in the front-month contract tumbling back to key support at the 200-week moving average. Based on its track record around this level, it cannot be stressed how important its near-term price performance may end up being for prices over the longer-term.

One look the weekly chart below shows not one nor two but ten separate tests of the 200-week moving average over the past year without ever closing below it. Bulls will be hoping this week will be no exception to the broader rule, while bears will looking for a clean break lower, opening the door to move back into the high 60s or potentially far lower.

While there are no shortage of potential catalysts that can move the WTI crude price, none least geopolitics given concerns about supply disruptions to Europe created by attacks on cargo ships by Houthi rebels in the Red Sea, there may be a potential catalyst that may exacerbate downside for crude prices this week.

According to analysts at Citigroup, funds tracking the Bloomberg Commodity Index and S&P GSCI may sell around $2 billion in WTI crude oil futures this week to mirror new weightings following their annual rebalancing, generating additional downside risks to those already prevalent. With the supply-demand outlook already dire, forced selling from funds may lead to a clean downside break of the 200-week moving average.

Below that key level, bids may be found at $68 before a more pronounced support zone at $66 kicks in. Beyond, $61.80, $58.85 and $51.50 are the next levels to watch. Should WTI crude fail to close below the 200-week MA this week, upside is likely to be capped by resistance starting from $73.80 and the 60-week moving average located at $77.30.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade