- China A50 futures endure ugly start to trade on Thursday

- Price has gapped lower below the 200-day moving average

- When this oversold in the recent past using RSI, futures have often bounced

- With two support levels in close proximity, we look at a potential trade setup

China A50 stock futures have been hammered on Thursday, as have most other equity futures across Asia. The US dollar is breaking out as US Treasury yields push higher, seeing traders abandon riskier positions ahead of quarter-end. The baby is being thrown out with the bath water.

But, for how much longer?

China A50 futures in bounce territory

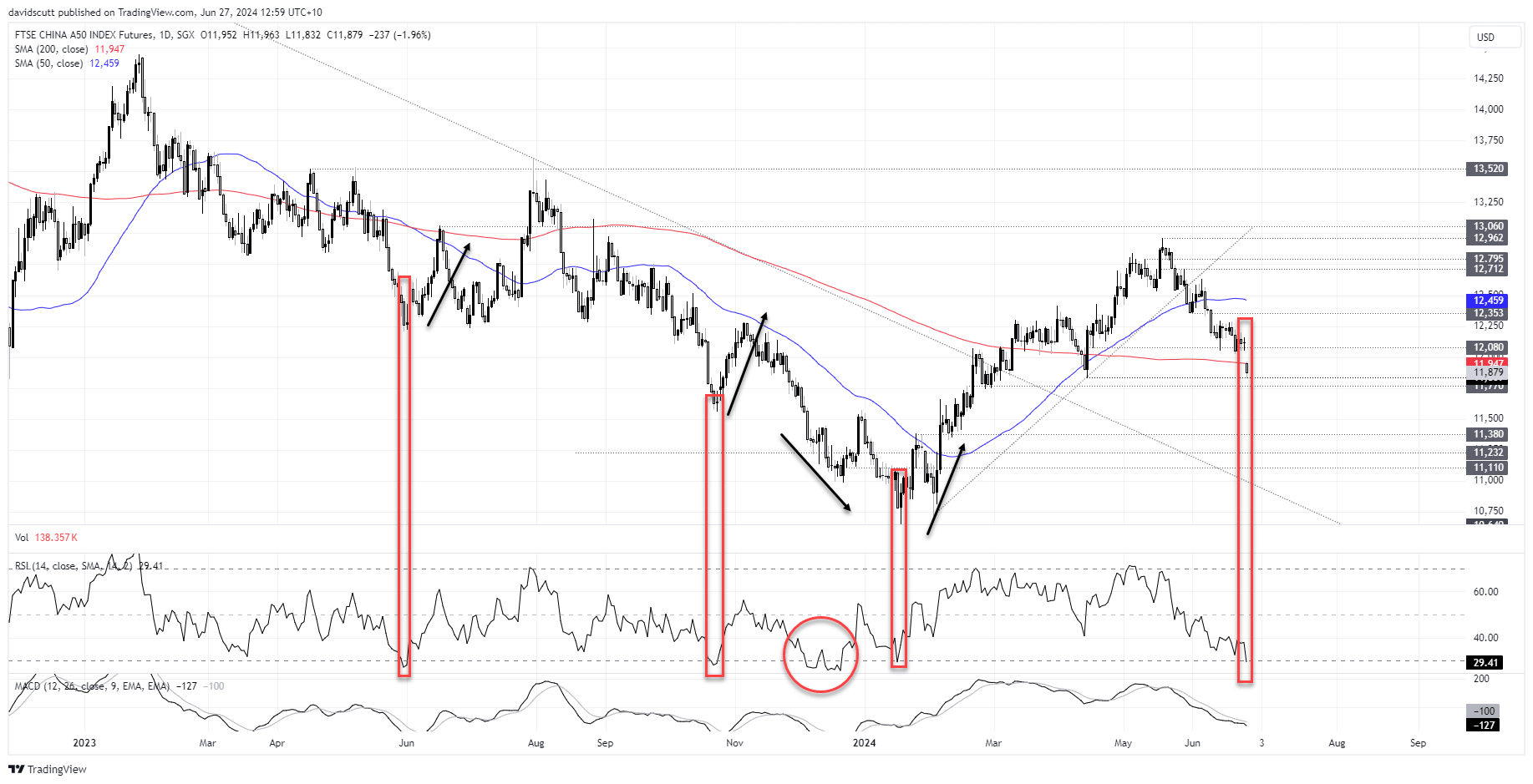

Such has the degree of selling been in China A50 futures, it’s seen the price slide into oversold territory using RSI on a daily timeframe. I’m not going to dispute how ugly the price action has been – it is – but it’s interesting to note how the market has fared when this oversold in the recent past.

Zooming out, you can see scores below 30 on RSI have regularly coincided with market bottoms. And even when we haven’t seen a bounce, there wasn’t immediate follow through selling with the price ambling sideways before eventually dribbling lower.

Past performance is not indicative of future returns, and this time could easily be different. We’re only talking about a limited sample size, after all. But with two horizontal support levels located just below, the tendency to bounce creates an interesting trade setup.

China A50 futures gap lower in ugly open

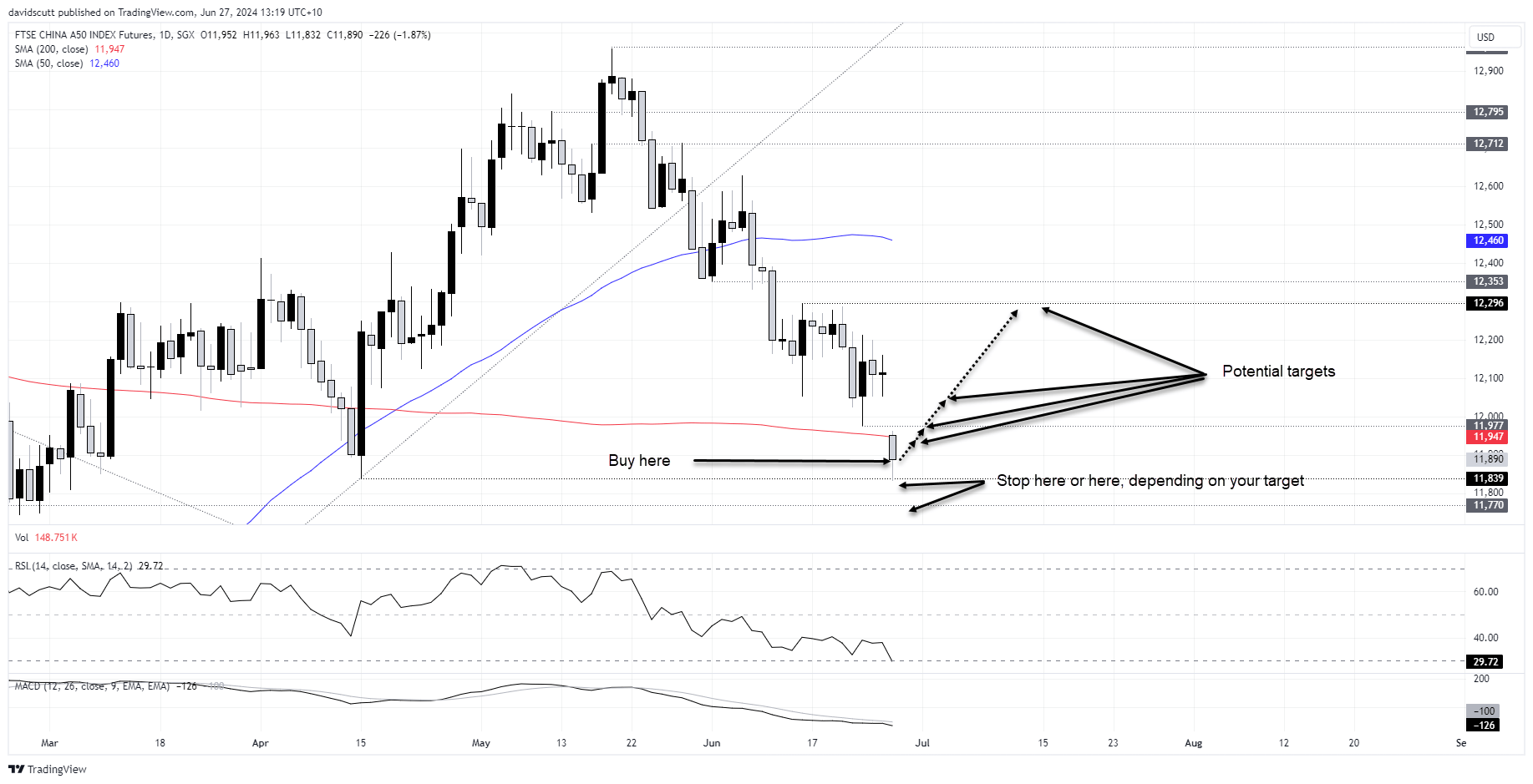

Zooming in, you can see how ugly the price action has been, with futures not only gapping lower but doing so through the 200-day moving average, a level that’s often been respected including for periods earlier this year.

Long setup

Given support held at 11839 when tested earlier in the session, those contemplating longs could buy here with a stop just below the level for protection.

On the topside, the 200-day moving average would be the initial target. Just above, 11977, where futures bottomed earlier this week, is another possibility given the risk we may see traders attempt to close the gap created by the sharply lower open. But even then, the risk-reward does not screen as compelling. Realistically, to make the trade appealing, the target would have to be higher.

12054, where futures bottomed on Tuesday and Wednesday prior to the gap lower, would make it more palatable. Above, 12296 comes across as another possible target.

Depending on whether you take on trade and entry level at the time, you could also consider placing a stop below 11770 for protection, especially if you’re looking for one of the higher targets.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade