- Australia’s inflation indicator shows price pressures remain far above the RBA’s target

- Annual rates for headline and underlying inflation are trending flat to higher

- High inflation increases the risk of the RBA being forced to hike rates again

- AUD/USD strengthens on rate differentials but ASX 200 futures sink

Disinflationary forces in Australia have stalled with annual rates for headline and underlying inflation trending flat to higher, and well above the 2.5% midpoint of the RBA’s target. Not only does that weaken the case for rate cuts but means the next move from the RBA may be a hike. That may support AUD/USD based purely on interest rate differentials but could spell trouble for the ASX 200 which is already richly valued relative to historic norms.

Australian inflation remains hot and sticky

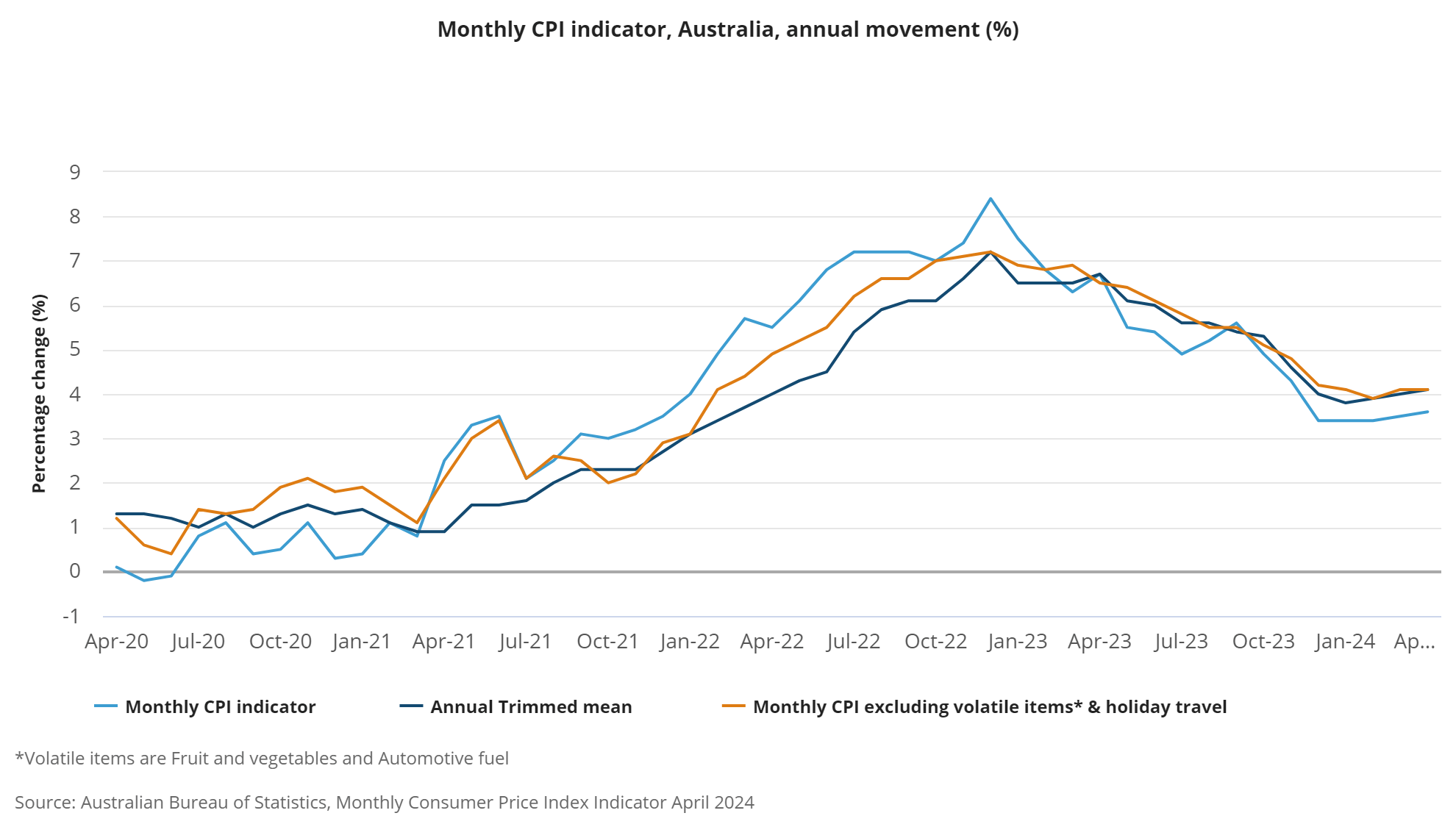

According to the ABS monthly inflation indicator, consumer prices increased 3.6% in the year to April, above the 3.4% pace expected by economists and 3.5% level reported in the 12 months to March. Helping to prevent an even larger surge, the ABS said electricity rebates continued to temporarily suppress prices, resulting in 4.2% increase over the year rather than a 13.9% lift that would have otherwise been the case.

Like the headline figure, underlying measures that strip out volatile price movements were also flat to higher on an annualised basis, indicating price pressures remain elevated across much of the inflation basket.

Prices excluding fresh food, fuel and holiday travel rose 4.1% over the year, unchanged from the pace reported in March. While it comes with the caveat that April’s survey largely reflects movements in goods rather than services, the RBA’s preferred measure of underlying inflation pressures, the trimmed mean rate, accelerated from 4% to 4.1%, some 1.6 percentage points above the 2.5% midpoint of its inflation target.

Source: ABS

RBA’s next move may not be to cut

Not only is that key measure elevated but it’s moving further away from the RBA's target, making the case for rate cuts extremely weak. At its May monetary policy meeting, the RBA acknowledged the flow of information since its March meeting had increased the risks of inflation staying above target for longer. It also warned that it had “limited tolerance” for inflation returning to its later than 2026.

While the April inflation indicator is unlikely to warrant an immediate policy response, the more evidence that accumulates to suggest inflation is unlikely to return to target, the greater the risk it may be forced to start hiking rates again.

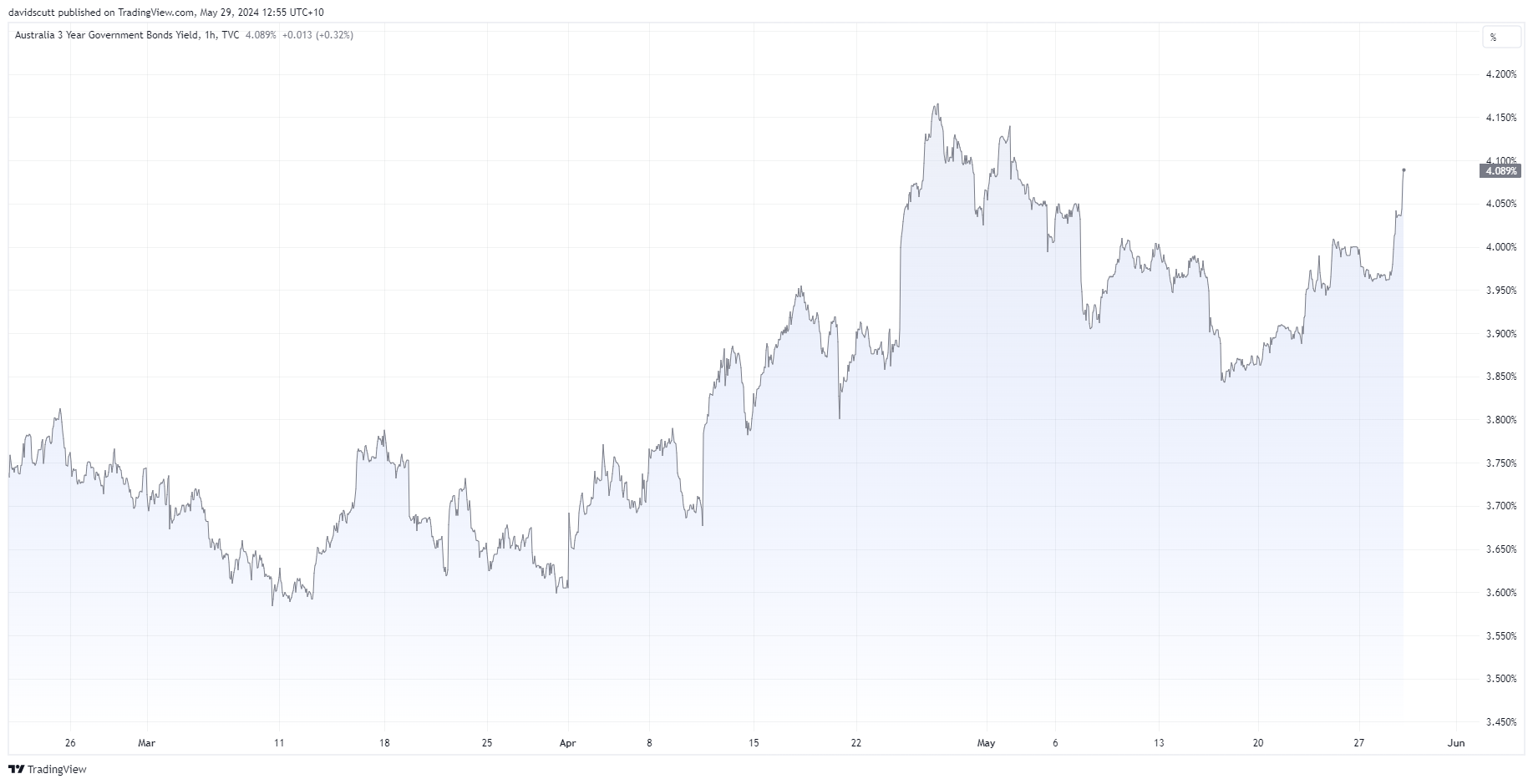

Australian bond yields spike

Already under pressure on the back of a sell-off in global bonds, Australian 3-year government bond yields – which are sensitive to changes in the RBA interest rate outlook – surged to a four-week high of 4.087% following the report, extending the bounce from the recent lows to 26.8 basis points. That’s not insignificant, further extending the time horizon for potential rate cuts well into the second half of 2025.

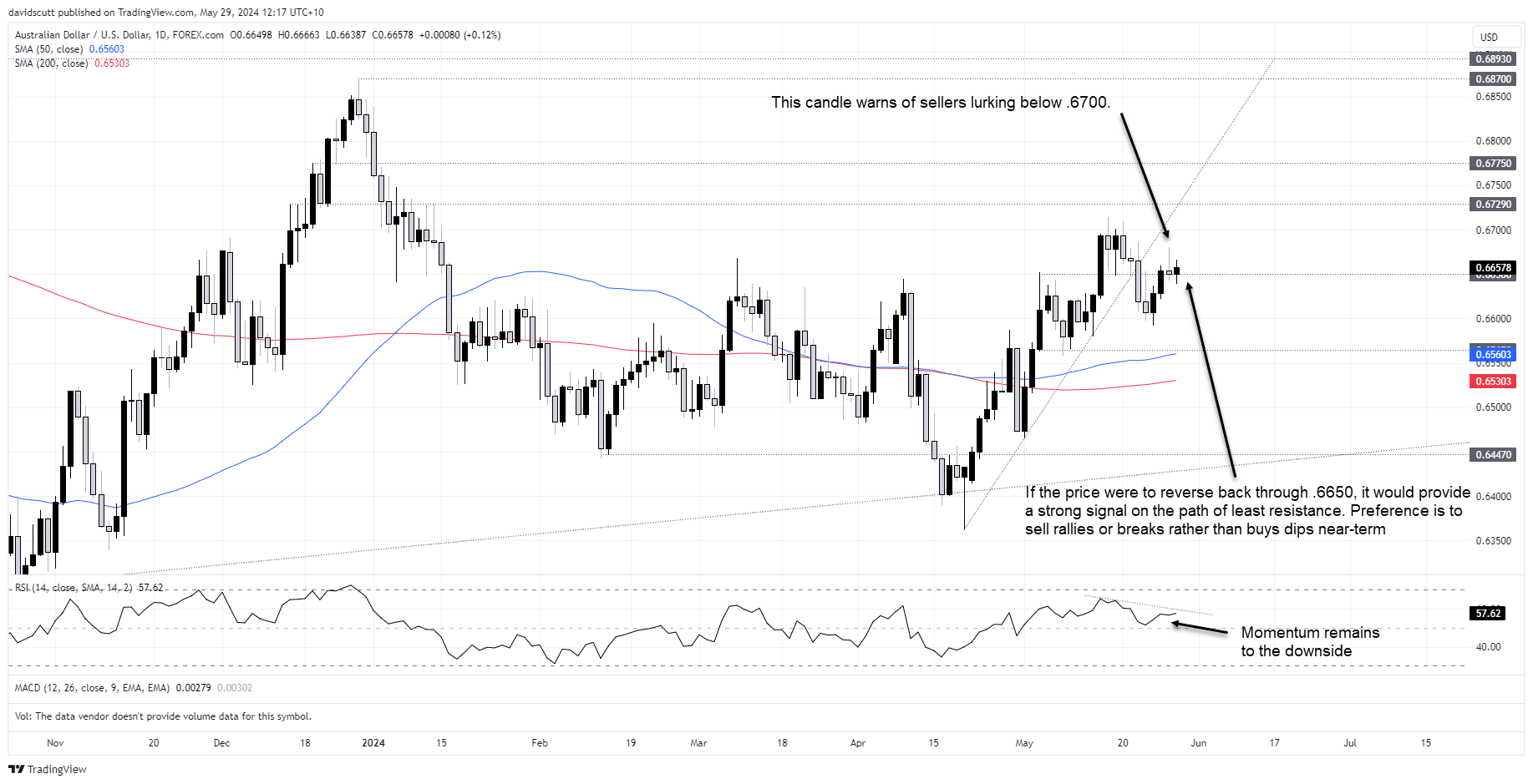

AUD/USD pops but looks vulnerable to downside

The AUD/USD jumped as much as 0.25% as soon as the data dropped, reflecting the risk that the next move from the RBA may easily be to hike rather than cut. However, those gains have been pared somewhat, underlining that global factors remain the main driving force behind the Aussie dollar’s movements.

You can see on the daily chart that .6650 is acting like a pivot point with the price doing plenty of work either side of it dating back several months. While AUD/USD sits marginally above this right now, the inverted hammer candle that printed on Tuesday warns of sellers are lurking above. And with momentum indicators such as RSI pointing lower, a reversal below .6650 would be a strong signal on the path of least resistance near-term.

The preference is to sell rallies or breaks rather than buy dips, but let the price action guide you. A push back towards Tuesday’s high of .6680 would make for a decent entry level for shorts, allowing for a tight stop to be placed above for protection. Alternatively, should AUD/USD reverse back through .6650, consider selling the break with a tight stop loss above. Potential trade targets include .6565 or .6480.

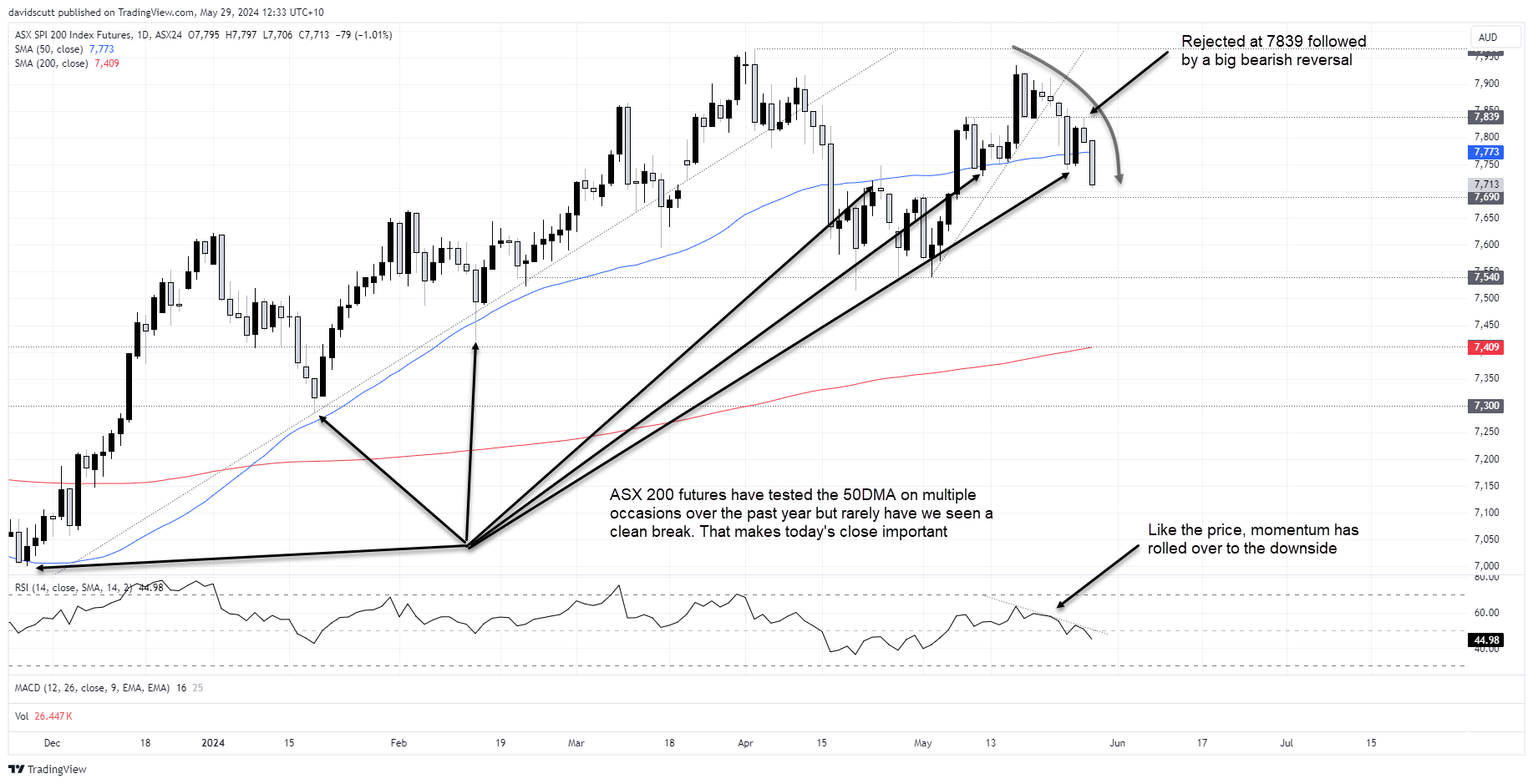

Important close for ASX 200 futures

While the Aussie dollar found buyers on the back of the inflation data, the opposite occurred for ASX 200 futures. The daily chart looks ordinary for bulls, convincingly rejected at 7839 on Tuesday before tumbling to trade through the 50-day moving average today.

That level has been very important in recent years, often tested but very rarely broken cleanly. That’s why today’s session looms as potentially important. If futures can’t climb towards the close of the day session, recent history suggests traders should consider to reverting to selling on rallies rather than buying dips.

While momentum traders may like to sell here, I’m waiting to see what happens into the close. But should futures close below the 50DMA, it looks far easier to get short if the risk-reward of the trade is suitable. On the downside, minor support is located at 7690 with more pronounced buying likely to emerge at 7541.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade