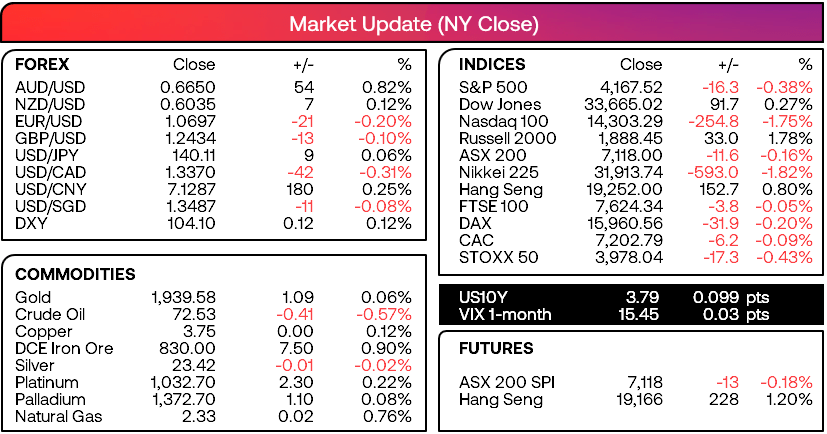

Market summary

- CAD was the strongest major as the BOC hiked interest rates by 25bp to 4.75%

- Consensus was for a hold

- Stubbornly high inflation was cited as the reason for the hike

- But it is potentially another ‘one and done’ (for now)

- USD/CAD fell to trend support, CAD/JPY hit a fresh YTD high in line with our bias

- The Nasdaq 100 fell for the first day over five as hikes by the RBA and BOC this week spurred bets that the Fed may not pause after all next week

- A bullish outside day formed on USD/JPY and closed above 140, hinting at a potential upside break of the June high

- Australian growth continued to diminish with GDP rising just 0.2% q/q (0.3% expected, 0.6% prior) or 2.3% y/y (2.4% expected, previous downgraded to 2.6% from 2.7%)

- AUD/USD snapped a 4-day wining streak and formed a daily bearish hammer, following a false break of 0.6700

- Momentum turned for WTI after finding support at $70 and reaching our initial resistance zone within its choppy daily range

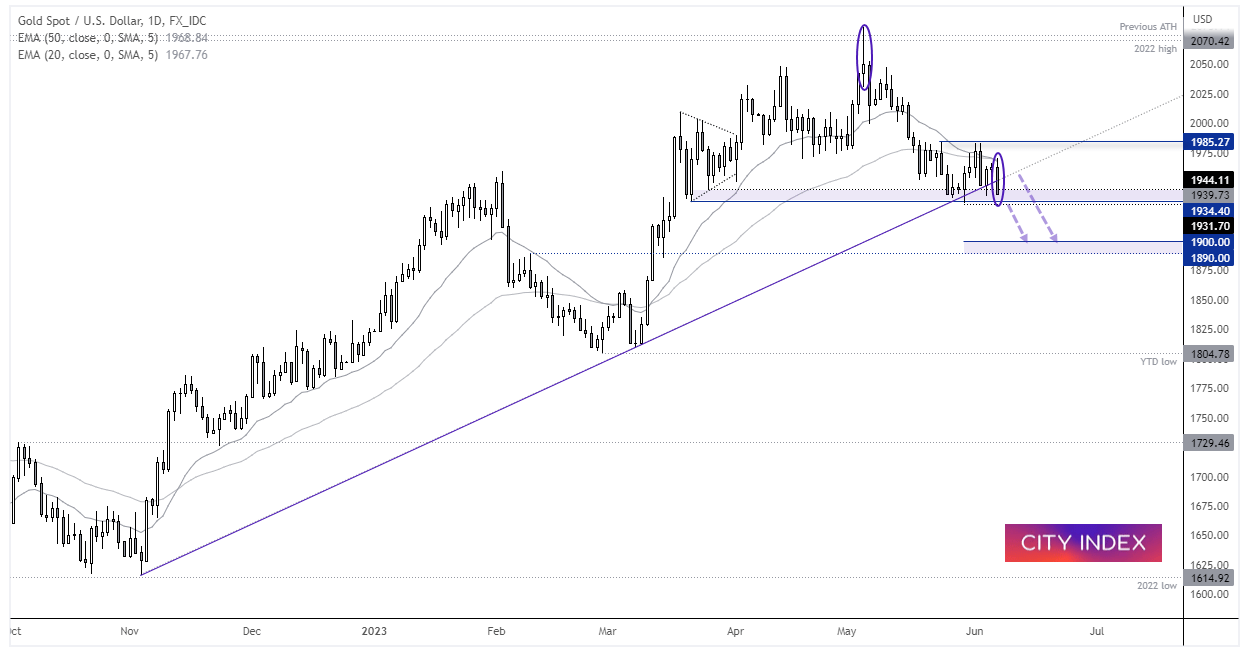

- Gold lower formed a bearish outside day and closed beneath trend support

- The Turkish lira fell to a fresh record low against the US dollar as authorities appear to be moving back to a free market and loosening their grip of state control

- The Nikkei 225 suffered its worst day in nearly two months at its 32-year high and formed a bearish engulfing candle, as investors seemingly err on the side of caution following its strong rally

Please note that the next report will be on Tuesday 13th of June

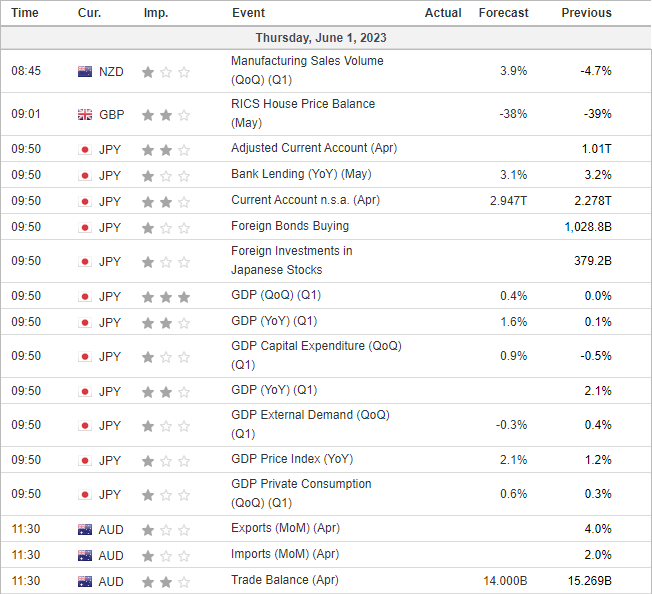

Events in focus (AEDT):

- 09:50 – Japan’s GDP

- 11:30 – Australia’s trade balance report

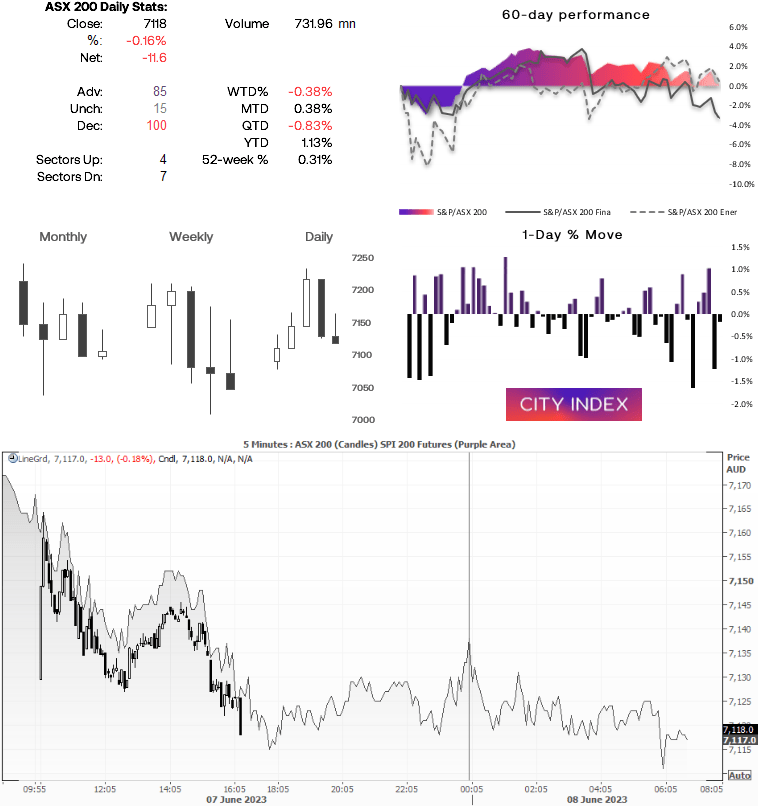

ASX 200 at a glance:

- The ASX 200 closed lower for a second day, at the low of the day

- Yesterday’s high formed around yesterday’s intraday resistance level of 7161.5

- 7110, 7100 and 7078 are the next support levels for bulls to defend (bears to target)

- Tech stocks could underperform today due to the weak lead from the Nasdaq

Gold daily chart:

We warned that it looked tough at the top for gold one month ago, looking at the monthly and weekly candles. Since then, we have seen a second bearish hammer form on the monthly chart (which is also an outside candle), and prices have spent the best part of the last three weeks below 2000 and probing key support. The daily chart has been flirting with a break of the November trendline, and yesterday’s bearish engulfing candle saw a firm close beneath it. We’re now waiting for a break of the 1931.7 low to assume its next leg lower, where bears could then seek to fade into pullbacks below resistance, with the next major support zone residing around 1900.

We warned that it looked tough at the top for gold one month ago, looking at the monthly and weekly candles. Since then, we have seen a second bearish hammer form on the monthly chart (which is also an outside candle), and prices have spent the best part of the last three weeks below 2000 and probing key support. The daily chart has been flirting with a break of the November trendline, and yesterday’s bearish engulfing candle saw a firm close beneath it. We’re now waiting for a break of the 1931.7 low to assume its next leg lower, where bears could then seek to fade into pullbacks below resistance, with the next major support zone residing around 1900.

Asia Data Calendar (AEDT):

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Latest market news

Yesterday 04:00 PM

December 25, 2024 08:00 PM

December 25, 2024 02:00 PM

December 25, 2024 07:00 AM

December 25, 2024 02:00 AM

December 24, 2024 08:00 PM