GBP/USD H2 2024 forecast

- Introduction

- Rate cut expectations

- What factors will influence the pound in H2

- What factors will influence the US dollar in H2

- GBP/USD technical analysis

Introduction

GBP/USD has outperformed its significant peers across the first half of the year, rising 1.3%. GBP’s solid performance hasn’t been confined to gains against the USD. The pound has also booked solid gains against other major currencies in H1. GBP/EUR rose to a 22-month high, GBP/JPY has risen to the highest level since 2008, and GBPCAD has risen to a 24-month high.

Despite GBP/USD’s gains in H1, the pair trades rangebound between 1.23 and 1.2850. Heading into H2, the fundamental backdrop shows that the UK economy faces some challenges, which could exert downward pressure on GBP/USD, but this may not be sufficient to break out of its defined range.

GBP/USD outlook – rate cut expectations

At the time of writing in late June, the markets are pricing in similar amounts of monetary policy easing from both the Federal Reserve and the Bank of England. Despite expectations of several rate cuts earlier in the year, expectations are now for two 25-basis point rate cuts from the BoE this year, possibly in August and November. Meanwhile, the Federal Reserve downwardly revised its dot plot to indicate just one rate cut this year, lowered from 3-rate cuts projected in March. However, despite the Fed’s projections, the market is still pricing in 2 -rate cuts this year following weaker-than-expected US CPI data.

When considering the health of the two economies, the bias could be slightly towards more BoE rate cuts over US rate cuts, which could bring GBP/USD lower. However, this may not be sufficient to result in a break out from the recent range.

What factors will influence the pound in H2?

GBP/USD outlook- UK Economic factors

Inflation in the UK cooled to 2.3% YoY in April, close to the BoE’s 2% target. Meanwhile, data has also shown that the hot jobs market is starting to slow. Unemployment rose to 4.4%, its highest level in 2 ½ years, and the economy stalled in April as the recovery from last year’s recession appears to have run out of steam.

However, wage growth and services inflation, which the BoE closely watches, are still around 6%. The BoE will want to see these figures cooling further before cutting rates.

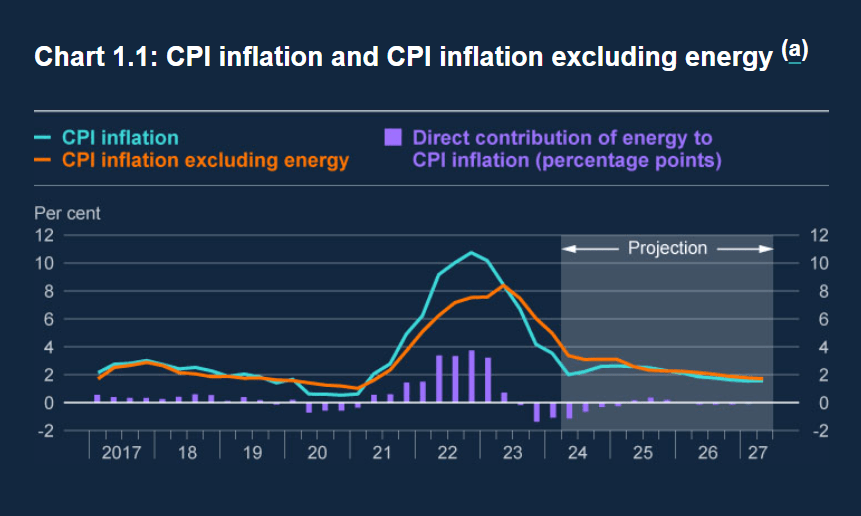

The BoE expects CPI to hover around 2.5% across the second half of the year amid a pick-up in energy inflation. However, it also expects services CPI to gradually ease from 6% and private sector pay growth to reduce to 5% over the coming months. Should inflation trend along the predicted trajectory, two rate cuts look likely.

Source: BoE May Monetary Policy Report

Service sector inflation and wage growth are risks to this projection. A shortage of skilled staff post-Brexit could keep wage growth strong, even as unemployment picks up. This could result in the BoE delaying rate cuts. Such a scenario could delay rate cuts and lift the pound.

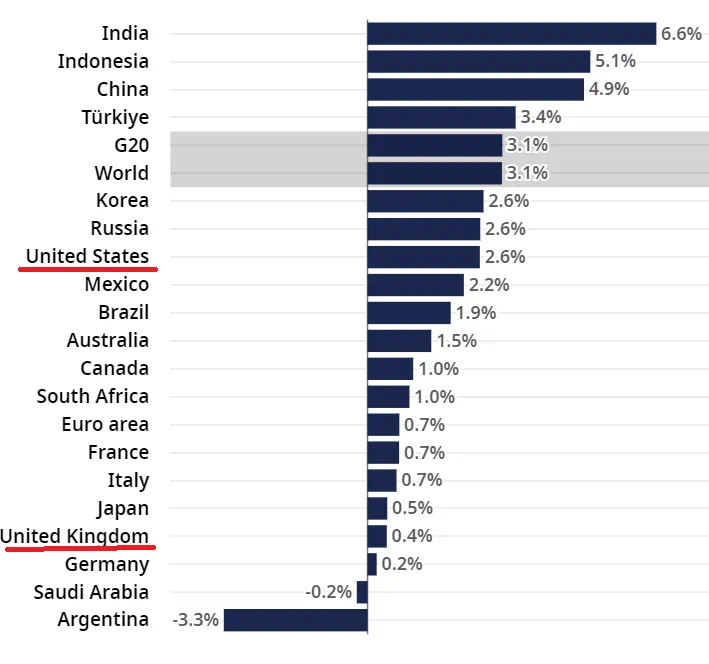

Meanwhile, UK economic growth is expected to remain sluggish. According to the OECD, the UK economy is expected to grow 0.4% this year, marking the slowest growth rate for all G-7 economies.

More than a quarter of all homeowners with fixed-rate mortgages will face a sharp increase in monthly payments before the end of 2024, which could impact consumer demand across the second half of the year. Recent retail sales data has been weak and could slide further as household budgets are squeezed.

GBP/USD outlook: UK Political factors

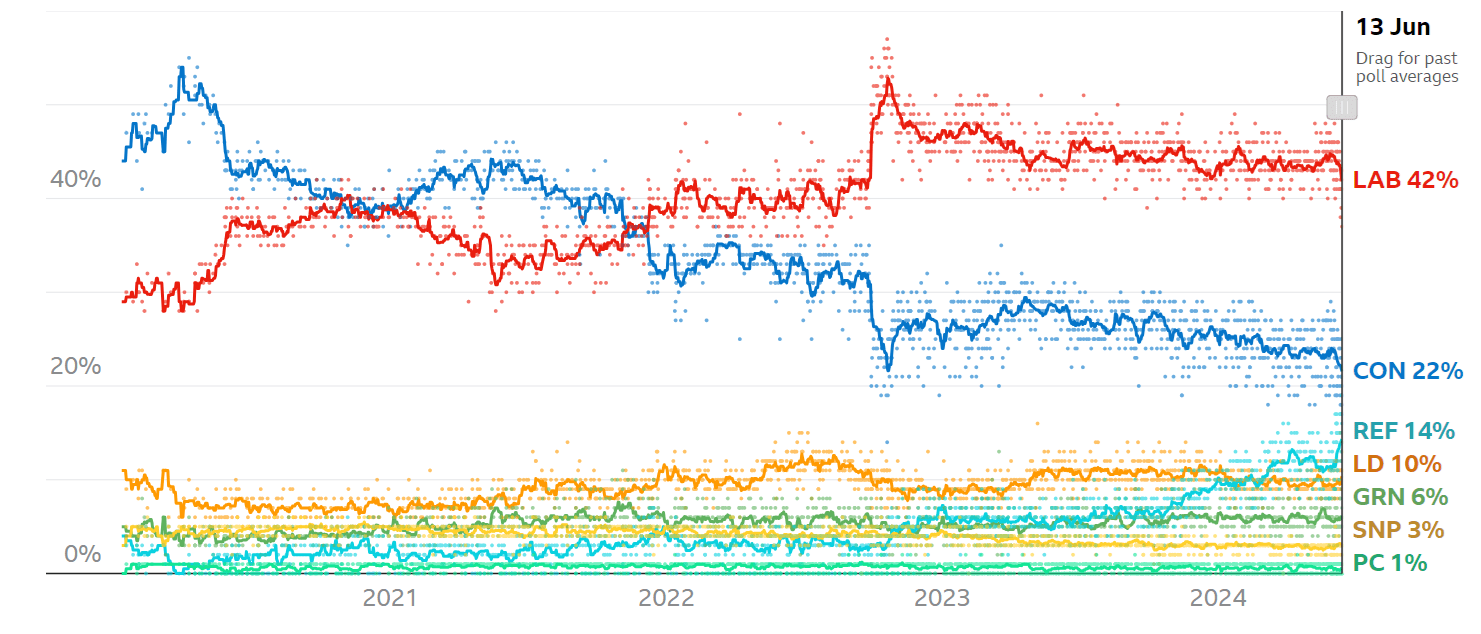

UK Prime Minister Rishi Sunak called an election on July 4th, at the start of the H2. The Labour Party is ahead in the polls and is widely expected to win the election, which would be considered a good outcome for the pound. A hung parliament in the election is regarded as the worst outcome for the pound.

A Labour government means a break from the Conservative in-fighting, which has damaged the party's traditionally market-friendly brand, but the change won’t undo the damage done by Brexit. Given the weak growth forecasts and Labour’s pledges not to raise taxes, their policies are not likely to differ too significantly from the current government’s. As a result, the BoE and rate cut expectations are likely to have more of an impact on GBP than the change of government, at least for this year.

What factors could influence the USD in H2?

GBP/USD outlook- US Economic factors

At the time of writing, US inflation was still at 3.4% YoY, which was considerably above the Federal Reserve’s 2% target. The jobs market is still relatively solid, with 272k jobs added in the May non-farm payroll and wage growth solid at 4.1%, although jobless claims are showing some signs of weakness seeping in.

Economic growth in the US is still strong, although it has slowed from last year. In Q1, the US recorded 1.6% annualized growth, down from 3.4% in Q4 2023. According to the OECD, the US is expected to experience growth of 2.6% in 2024, the strongest growth amid G7 economies. This is considerably stronger growth than what is expected in the UK.

The outlook for US inflation is also hotter than in the UK. In the June FOMC meeting, the Federal Reserve updated its inflation forecast and upwardly revised its core PCE forecast to 2.8%, up from 2.6%. This upward revision largely accounts for why the central bank shifted its stance and forecasts just one rate cut this year.

Still, recent data has been more volatile. Should economic data deteriorate in the coming months, the market re-pricing rate cut expectations could pull the USD lower.

GBP/USD outlook- US Political factors

The US election is due to take place on November 5th, and the race between President Joe Biden and former President Donald Trump is tight.

The market will likely welcome the continuity and stability that a second term from Biden would bring in the short term, which would likely leave the focus on the Fed and the timing of potential rate cuts.

However, at the time of writing, Trump has a slight lead in the polls over Biden. A Trump win could create more volatility in the financial markets, particularly if his administration picks up where it left off with protectionist policies. In this scenario, the USD could benefit from safe-haven flows.

GBP/USD Outlook – technical analysis

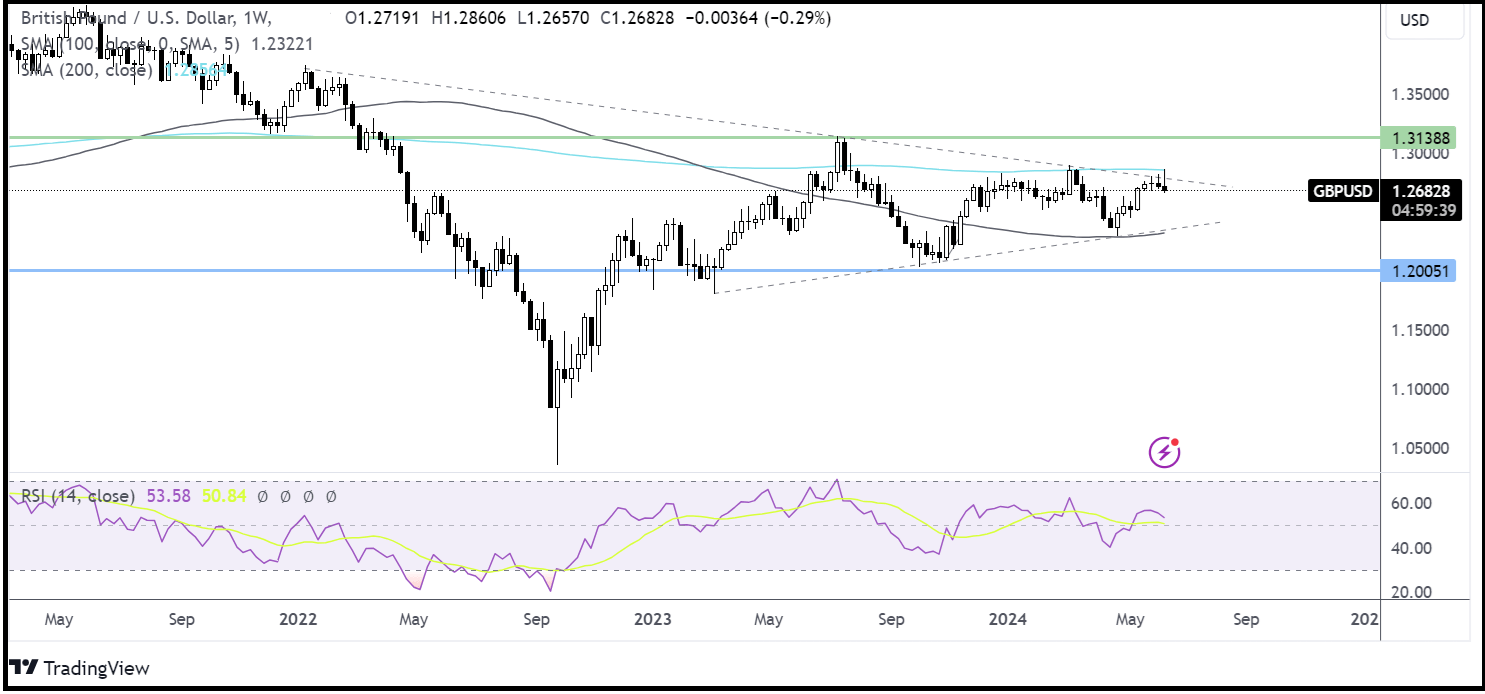

Looking at the weekly chart, GBP/USD has traded in the range between 1.23 at the 100 SMA and the 2024 low and 1.2850 at the 200 SMA. The RSI is also neutral.

GBP/USD also trades in a symmetrical triangle, recovering from the rising trendline support of 1.23, which is also the confluence with the 100 SMA, to trade below the falling trendline resistance, just below the 200 SMA.

A bullish breakout could see GBP/USD rise above the 1.2850 level to create a higher high and rise towards 1.3150, the July 2022 high. Given the current outlook, a rise to 1.3150 looks unlikely.

However, sellers could be supported by the long upper wicks on recent candles and look to push the price lower. Sellers will need to take out the 50 SMA at 1.2570 to extend losses to 1.23, the 100 SMA, and the 2024 low. Given the current outlook, a break below this level looks unlikely.